Over the past five years, the price of chicken in the UK has experienced significant fluctuations due to a variety of factors. This analysis examines trends in both retail and live chicken prices, the drivers behind these changes, and offers a forecast for the coming years.

Historical Price Trends

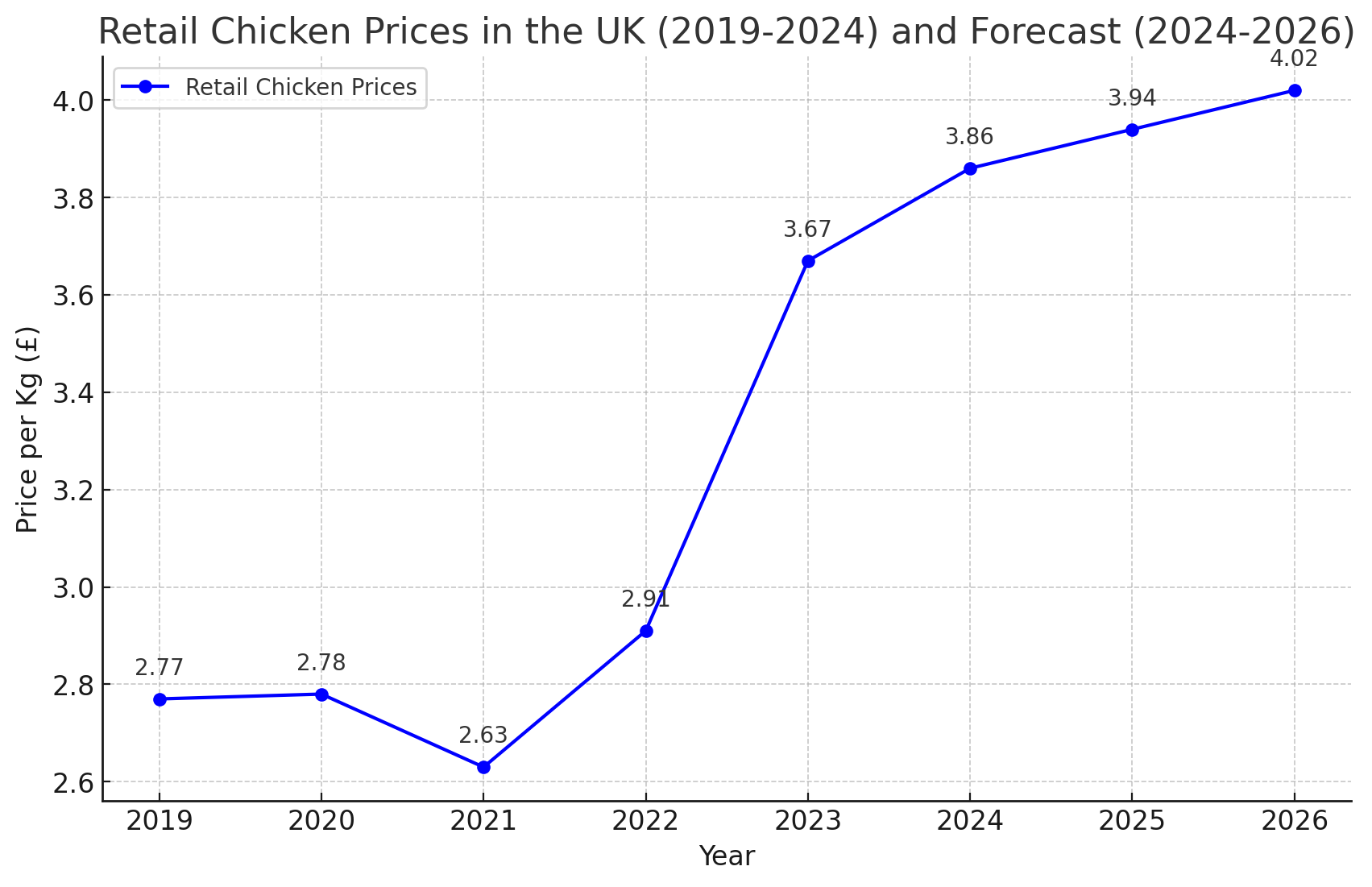

Retail Chicken Prices: The price of chicken meat in retail markets has risen steadily over the past five years. In 2019, the average price for oven-ready chicken was approximately £2.77 per kilogram. By the first quarter of 2024, this price had increased to £3.86 per kilogram, marking a notable 39% rise.

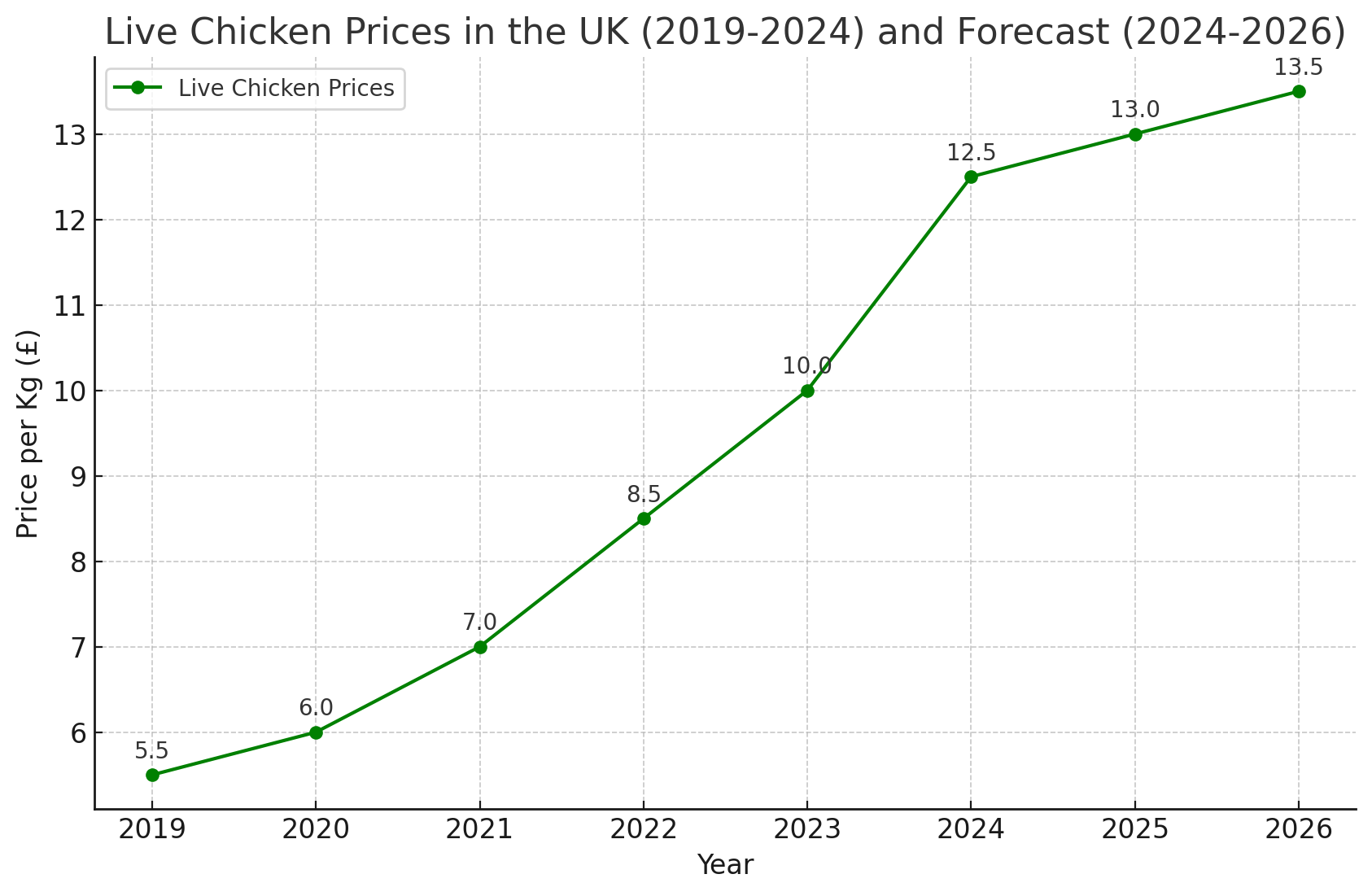

Live Chicken Prices: Similarly, the cost of live chickens on farms has seen substantial growth. In 2019, live chickens were priced around £5.50 per kilogram. By mid-2024, prices had doubled, ranging between £11.72 and £14.85 per kilogram. This increase was driven by higher feed costs, labor shortages, and increased input costs influenced by global events.

Factors Driving Price Changes

-

Inflation and Supply Chain Disruptions:

- The COVID-19 pandemic and geopolitical tensions, particularly the Russia-Ukraine conflict, disrupted global supply chains. These disruptions led to increased costs for feed, fuel, and other essential inputs.

- Inflation soared, with food inflation reaching its peak in March 2023 before starting to ease in 2024.

-

Rising Feed Costs:

- Feed prices, a significant component of poultry production costs, have been highly volatile. Global grain markets and climate conditions affecting crop yields have contributed to these fluctuations.

-

Labor and Energy Costs:

- Labor shortages, exacerbated during the pandemic, increased wages and overall production costs.

- Energy costs for heating and processing facilities surged due to rising global oil and gas prices.

Price Analysis and Forecast

Analysis: The upward trend in chicken prices reflects broader inflationary pressures and specific challenges within the agricultural sector. The increase in live chicken prices has directly impacted retail prices as producers pass on higher costs to consumers.

Forecast: Looking ahead, it is expected that chicken prices will stabilize but remain higher than pre-pandemic levels. Several factors will influence this trend:

- Continued Inflation Control: Efforts by the Bank of England to control inflation, including maintaining higher interest rates, are expected to moderate price increases.

- Supply Chain Adjustments: As global supply chains adapt post-pandemic, some cost pressures may ease, particularly if geopolitical tensions stabilize.

- Technological Advancements: Innovations in feed efficiency and poultry farming practices may help mitigate some cost increases.

A conservative forecast suggests that retail chicken prices may see modest increases of 2-3% annually over the next few years, contingent on stable input costs and successful inflation management.

Visual Data

To illustrate these trends, the following charts provide a visual representation of the price changes:

- Retail Chicken Prices (2019-2024) and Forecast (2024-2026):

- Live Chicken Prices (2019-2024) and Forecast (2024-2026):

Conclusion

The past five years have been marked by significant volatility in chicken prices in the UK, driven by a complex interplay of global and local factors. While prices are expected to stabilize, the industry must remain adaptive to ongoing economic challenges. Consumers and producers alike will need to navigate this evolving landscape with resilience and innovation.